1 Department of Management, Central University of Tamil Nadu, Thiruvarur, Tamil Nadu, India

2 Institute of Public Enterprise, Hyderabad, Telangana, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

This study examines how e-commerce influences the online shopping habits of banking professionals, with a particular focus on the mediating role of personal factors. A quantitative approach was employed, using a cross-sectional survey to collect primary data from 496 banking professionals across South Indian states. The data were analyzed using partial least squares structural equation modeling (PLS-SEM) with SmartPLS 4.0 software. The findings indicate that e-commerce positively affects online purchase intentions, with personal factors—such as individual values, occupation, lifestyle, income, societal trends, cultural influences, and social recommendations—significantly mediating this relationship. Additionally, e-commerce has a positive impact on personal factors. The study provides actionable insights for e-commerce platforms and digital marketers to develop tailored strategies for banking professionals addressing their needs and preferences. Policymakers may also leverage these findings to enhance digital consumer protection initiatives. By focusing on this unique demographic, the study contributes to the academic discourse on digital consumer behavior and offers practical implications for future research.

E-commerce, online purchase intentions, banking professionals, personal factors, digital consumer behavior, PLS-SEM

Introduction

The swift rise of e-commerce has significantly transformed how consumers behave, especially regarding their intentions to purchase online. E-commerce platforms have become vital to the modern marketplace, offering consumers unparalleled convenience, variety, and accessibility. This transformation is driven by many factors, ranging from technological advancements to shifts in societal trends and personal preferences (Rosenbloom, 2000). However, the effect of e-commerce on specific professional groups, such as banking professionals, remains underexplored. Banking professionals represent a financially literate and tech-savvy segment of the workforce whose purchase intentions may differ from others due to their unique professional responsibilities, financial stability, and exposure to digital marketing platforms. This study seeks to examine how e-commerce influences the online purchase intentions of banking professionals, with a particular focus on the mediating role of personal factors such as values, occupation, lifestyle, income, societal trends, cultural influences, and social recommendations, all play pivotal roles in shaping purchasing decisions on digital media platforms (Dwivedi et al., 2021). As consumers navigate many online options, these factors can significantly impact their preferences and buying behaviors. Personal values are intrinsic beliefs that guide individuals’ behavior and decision-making processes (Lichtenstein et al., 2017; Vinson et al., 1977). In e-commerce, these values can influence preferences for specific brands, products, or ethical considerations. Occupation, particularly among professionals like bankers, can also substantially impact. The nature of their work, income levels, and professional responsibilities can shape their online shopping habits and preferences. Lifestyle encompasses the activities, interests, and opinions that characterize an individual’s way of living (González & Bello, 2002). It directly affects how consumers engage with e-commerce platforms, dictating their shopping frequency and product types.

Similarly, income levels determine purchasing power, influencing the scope and scale of online shopping activities. High-income individuals may prioritize convenience and premium products, while those with limited budgets might seek value-for-money deals and discounts (Shergill & Chen, 2004). Societal trends and cultural influences are critical in shaping consumer behavior. These macrolevel factors encompass prevailing social norms, cultural values, and widespread trends that affect consumer preferences on a broad scale. Additionally, family, friends, and colleagues’ recommendations (social proof) are crucial in the decision-making process (Hu et al., 2019). In the digital age, social media and e-WOM (electronic word-of-mouth) have amplified the impact of these recommendations, often guiding consumers toward or away from specific products and services. The personalization of digital marketing content has emerged as a powerful tool in influencing online purchase intentions. Tailored advertisements, personalized recommendations, and targeted marketing campaigns can create a sense of relevance and engagement, driving consumers toward impulsive purchases. Moreover, the role of influencers on digital platforms has grown significantly, with many consumers willing to purchase products recommended by trusted influencers.

This study examines these multifaceted factors within the specific context of banking professionals. By analyzing how personal factors (i.e., personal values, occupation, lifestyle, income, societal trends, cultural influences, and social recommendations) mediate the relationship between e-commerce platforms and online purchase intentions, this research seeks to provide a comprehensive understanding of digital consumer behavior. The unique focus on bankers offers insights into a financially literate and tech-savvy demographic, providing a nuanced perspective on the interplay between personal factors and e-commerce usage. By investigating this specific demographic, the research aims to fill a gap in the literature regarding how personal factors mediate online purchase behavior within the context of financially literate professionals. The findings will offer insights for e-commerce platforms and marketers aiming to target specialized professional groups more effectively. Businesses can develop effective marketing strategies tailored to specific consumer segments by identifying the critical personal factors influencing online purchase intentions.

Furthermore, this study contributes to the academic discourse on consumer behavior in the digital age, offering valuable insights for future research. This research seeks to connect theory and practice, providing insights into the complex factors influencing online purchasing decisions among banking professionals. The insights gained will enhance our knowledge of digital consumer behavior and inform strategies to optimize the e-commerce experience for diverse consumer groups.

Literature Review and Hypothesis Development

The rapid growth of e-commerce has fundamentally transformed consumer behavior, particularly in the context of online purchase intentions. This transformation is driven by many factors ranging from technological advancements to shifts in societal trends and personal preferences. The following literature review synthesizes existing research on these factors and their impact on online purchase behavior, providing a foundation for the hypotheses tested in this study. Existing research has examined how various factors, such as technological advancements, societal trends, and personal values, influence consumers’ purchasing decisions on digital platforms (González & Bello, 2002; Mukhtar et al., 2023). This section synthesizes key findings from the existing literature, with each hypothesis emerging from a critical review of the theoretical and empirical studies, offering a well-grounded basis for the research model.

E-Commerce and Personal Factors

E-commerce platforms offer unparalleled convenience and accessibility, fundamentally altering how consumers engage with the marketplace. The rise of e-commerce has led to significant changes in consumer purchasing behavior, with many studies highlighting the various factors influencing these changes. Based on existing research, e-commerce influences personal factors such as lifestyle and occupation, which in turn shape online purchase intentions (González & Bello, 2002). Given that banking professionals possess unique work habits and financial expertise, they may exhibit different responses to e-commerce platforms compared to other consumer groups. These platforms allow for personalized interactions, fostering a tailored shopping experience that enhances customer satisfaction and purchase intention (Pappas et al., 2014). Specifically, personal factors—such as lifestyle, occupation, and income—are critical in shaping how consumers interact with e-commerce platforms.

Hypothesis 1: E-commerce has a positive impact on personal factors.

This hypothesis is grounded in the idea that e-commerce not only provides convenience but also influences how individuals align their lifestyle and purchasing behavior with digital trends. For instance, González & Bello (2002) suggest that individuals in professional roles, such as banking, often exhibit specific purchasing patterns influenced by their occupational demands and income levels. E-commerce platforms’ ability to offer highly personalized experiences is directly related to these personal factors, as consumers seek efficient and relevant shopping options (Sweeney & Soutar, 2001).

Personal Values and Online Purchase Intentions

Personal values are fundamental drivers of consumer decision-making processes, especially in an online environment. Consumers tend to align their purchases with brands or products that reflect their core beliefs and values, making personal values a strong predictor of purchase intention. Carrington et al. (2014) found that consumers with strong ethical considerations are more likely to purchase from brands that align with their social or environmental values. This alignment between values and e-commerce offerings often translates into higher online purchase intentions. The influence of personal factors—such as values, lifestyle, and occupation—on online purchase behavior has been extensively studied. For instance, banking professionals, who are typically financially literate and technologically adept, may have specific purchasing preferences that are informed by their professional and personal values (Hughes et al., 2019). As these personal factors drive a consumer’s approach to e-commerce, we posit that personal factors have a direct and positive influence on online purchase intentions.

Hypothesis 2: Personal factors have a positive impact on online purchase intentions.

E-Commerce and Online Purchase Intentions

The convenience and personalization afforded by e-commerce platforms have a direct impact on consumers’ purchasing intentions. Personalization, in particular, has been shown to be a powerful driver of purchase decisions in the online marketplace. Setyani et al. (2019) argue that personalized marketing campaigns significantly increase the likelihood of impulsive purchases, as consumers perceive these offerings as relevant to their specific needs and preferences. Similarly, Dabholkar and Sheng (2012) noted that e-commerce platforms’ ability to customize content for individual users plays a key role in driving purchase intentions. E-commerce’s impact on online purchase intentions is well supported by existing research, with studies showing that personalized digital marketing strategies effectively influence consumers’ decisions. Banking professionals, in particular, may respond positively to these tailored experiences due to their need for convenience and efficiency in managing time and resources. This hypothesis builds on the understanding that e-commerce fosters a direct, positive relationship between the platform’s offerings and the user’s intention to make purchases (Babi.png) Rosario et al., 2020).

Rosario et al., 2020).

Hypothesis 3: E-commerce has a positive impact on online purchase intentions.

The Mediating Role of Personal Factors

While e-commerce significantly influences purchase intentions, the role of personal factors as mediators in this relationship is equally critical. Personal factors such as lifestyle, occupation, and social recommendations serve as intermediaries between a consumer’s engagement with e-commerce platforms and their ultimate decision to purchase. Pappas et al. (2014) emphasized that experienced online shoppers exhibit different purchasing behaviors compared to novices, suggesting that personal experience and values play a mediating role in shaping consumer outcomes.

Hypothesis 4: Personal factors mediate the relationship between e-commerce and online purchase intentions.

This hypothesis is derived from the argument that personal factors—such as occupation, lifestyle, and values—intervene in the relationship between e-commerce and online purchase intentions. For banking professionals, the interaction between their professional responsibilities and personal lifestyle choices influences how they engage with e-commerce platforms and, subsequently, their purchasing decisions (Wagner Mainardes et al., 2019). Given that these factors mediate the consumer’s interaction with the e-commerce environment, this hypothesis highlights the nuanced role personal characteristics play in shaping the final purchase decision.

Social Influence and e-WOM

In today’s digital era, social recommendations, particularly through e-WOM, have become essential in influencing consumer purchasing decisions. Research by Kwahk and Kim (2017) and Yan et al. (2018) suggests that consumers are highly influenced by recommendations from peers, family, and colleagues, with these influences often amplified through social media platforms. E-commerce environments have leveraged this phenomenon to enhance their impact on consumer behavior, as consumers frequently rely on social proof to validate their purchase decisions. As personal factors mediate the impact of e-commerce on purchase behavior, social influences—such as e-WOM—can reinforce or shape the decisions banking professionals make when engaging with online platforms (Babi.png) Rosario et al., 2020). These influences are particularly important in the context of this research, as banking professionals may seek credibility and reliability in the products they choose, relying on recommendations from trusted networks.

Rosario et al., 2020). These influences are particularly important in the context of this research, as banking professionals may seek credibility and reliability in the products they choose, relying on recommendations from trusted networks.

Conceptual Framework

The conceptual framework for this study integrates these variables, illustrating the relationships between e-commerce, personal factors, and online purchase intentions. This framework is grounded in the theoretical understanding that personal factors mediate the influence of e-commerce on purchase intentions. The conceptual framework for this study examines how e-commerce influences the online purchase intentions of banking professionals, with personal factors acting as mediators (Figure 1). E-commerce platforms have revolutionized the consumer experience by providing convenience, personalization, and access to various products and services, significantly influencing consumer purchase intentions (Pappas et al., 2014). However, the role of personal factors—such as values, occupation, lifestyle, income, and social influences—in shaping online purchase decisions is underexplored in the context of banking professionals. Banking professionals, being financially literate and technologically proficient, exhibit unique purchasing patterns shaped by their professional responsibilities and financial standing (González & Bello, 2002; Servon & Kaestner, 2008). Personal values, for instance, guide individuals’ preferences and behaviors, aligning them with brands or products that reflect their ethical or social beliefs (Carrington et al., 2014). Similarly, the occupational demands of banking professionals influence their engagement with e-commerce platforms, as their work schedules and income levels often lead to a preference for convenient and time-saving shopping solutions (Hughes et al., 2019). Lifestyle and income further shape the frequency and scope of online purchases, while societal trends, cultural norms, and e-WOM amplify the impact of peer recommendations on purchasing decisions (Dang & Raska, 2022; Hernández et al., 2011; Hu et al., 2019; Swinyard & Smith, 2003).

Figure 1. Proposed Conceptual Model.

This framework posits that personal factors mediate the relationship between e-commerce and purchase intentions, as these individual characteristics influence how banking professionals interact with digital marketing content and platforms. By focusing on this financially literate demographic, the study aims to bridge the gap in existing literature regarding the role of personal factors in e-commerce behavior, providing insights that could inform targeted marketing strategies for professional groups (Ben Belgacem et al., 2024; Hernández et al., 2011; Setyani et al., 2019). Thus, the study contributes to a deeper understanding of digital consumer behavior, emphasizing the need for personalized marketing approaches that resonate with individual values and professional lifestyles.

Research Methodology

Research Design

This study uses a quantitative approach to examine the effects of e-commerce on the online purchase intentions of bank professionals, with a specific focus on the mediating role of personal factors. The research adopts a cross-sectional survey method to collect primary data from respondents in South Indian states, providing a snapshot of e-commerce and consumer purchase intention.

Sample and Data Collection

We collected primary data from 496 respondents residing in South Indian states, including Tamil Nadu, Telangana, and Karnataka. The sample was selected using a non-probability sampling technique to ensure that participants were bank professionals who frequently engaged with digital marketing platforms and made online purchases. We contacted participants online, such as social media, professional networks, and email invitations. To make our study practical, we used a nonprobability sampling method that combined convenience and snowball sampling. The data collection involved the researcher personally visiting employees and distributing the questionnaire, allowing individuals to participate voluntarily. We also shared the questionnaire via email and LinkedIn, asking recipients to complete it and forward it to others. This approach was suitable because our target audience comprised working professionals with reputable educational backgrounds recognized as digitally active users.

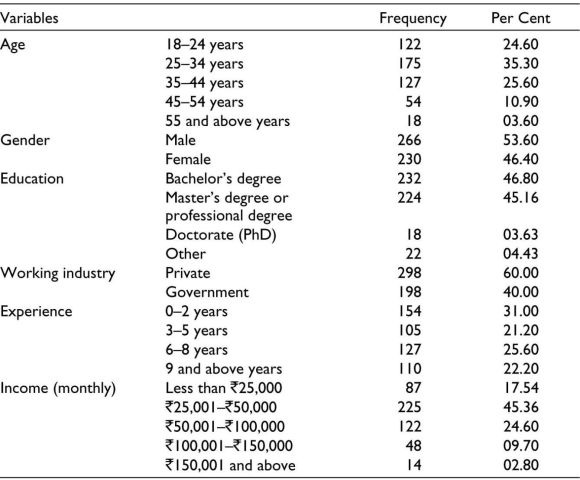

Our sample consisted of professionals who knew about digital marketing and digital platforms. We retained 496 valid responses. We analyzed the valid responses’ reliability, validity, and suitability for hypothesis testing. Our final sample included 266 (53.63%) male and 230 (46.37%) female respondents, reflecting balanced and active participation from both genders (Table 1). The IT professionals from different age groups, sectors, and profiles provide an actual representation and active participation across various categories. This diversity in the sample enhances the ability of the study to draw more generalizable conclusions.

Table 1. Demographic Information of Respondents.

Source: Questionnaire.

Measures

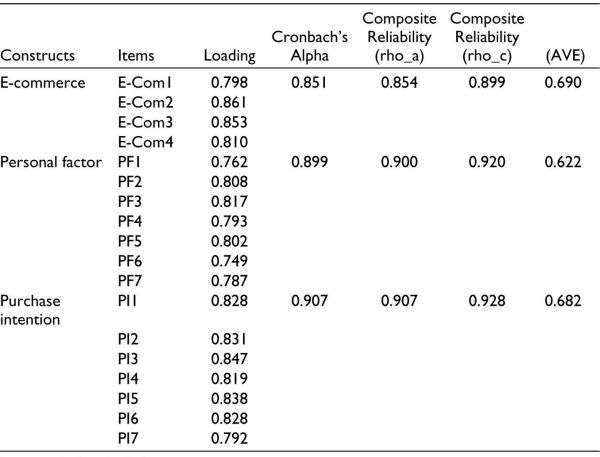

We adapted various constructs from existing research, making slight adjustments as required by the study. To gather data for the study, we asked participants to rate each statement on a five-point Likert scale, where “strongly disagree” represented 1 and “strongly agree” represented 5. All the detailed constructs and items can be found in the study. At the end of the survey, we also included questions about demographic factors, such as age, sex, education, income, and occupation. The instruments used in this study were derived from validated measurement items utilized in prior analyses (Table 2). The measured parameters depended on several conditions, such as the composite reliability value, which must be more than 0.6 (Chin, 1995); the average variance extracted (AVE) value must be more than 0.6 (Fornell & Larcker, 1981; J. Hair et al., 2017). The loading factor measurement forms the primary formers of the variable. The Cronbach’s alpha value should be >0.5.

Table 2. Research Instruments.

Source: Compiled and modified by the authors.

Methodology

We analyzed the data using PLS-SEM with SmartPLS 4.0 software. PLS-SEM is ideal for this research because it effectively manages complex models and works well with smaller sample sizes (Dash & Paul, 2021; Hair et al., 2019), making it an ideal choice for exploratory research. We used a measurement model and conducted structural model analysis under PLS-SEM to establish the reliability and validity of instruments and to test the association between various factors (Hair et al., 2017).

Table 3 shows the preferences of 496 respondents for various online retailers’ platforms, rated on a scale from 1 (not preferred) to 5 (most preferred). The data indicate the following trends: Amazon is found to be the most preferred platform, with 218 respondents rating it as “Most Preferred” and 195 as “Preferred.” Only 8 respondents rated it as “Not Preferred,” and Flipkart is Also favored, with 198 respondents marking it as “Preferred” and 149 as “Most Preferred.” However, it has more “Not Preferred” and “Least Preferred” ratings compared to Amazon. On the other hand, Myntra Shows a more balanced distribution across categories, with a higher count of neutral ratings (113). Mobile shopping apps are less preferred, with the highest number of “Not Preferred” ratings (147) and lower “Preferred” and “Most Preferred” ratings, while social media platforms are generally less favored, with significant numbers in the “Not Preferred” and “Least Preferred” categories.

Table 3. Preferences for Online Retailers’ Platforms (N = 496).

Source: Authors calculation.

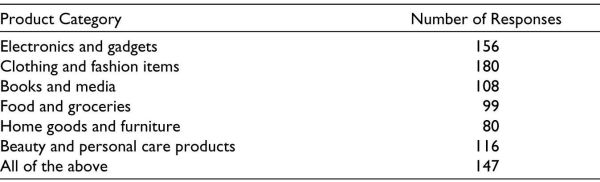

Table 4 displays the preferred types of products purchased from e-commerce platforms by 496 respondents. The respondents were allowed to select multiple categories, reflecting diverse shopping preferences:

Table 4. Preferred Types of Products Purchased from E-Commerce Platforms (N = 496).

Source: Authors’ calculation.

The data reveal a strong preference for purchasing clothing, fashion, electronics, and beauty and personal care products from e-commerce platforms. The notable selection of “All of the above” indicates that a significant portion of respondents utilize e-commerce platforms for a wide range of products, reflecting the versatility and broad appeal of online shopping.

Data Analysis

Collinearity affects outer loading estimation and statistical significance. We use Variance Inflation Factors (VIF) to check for multicollinearity in our model. If the VIF values exceed 5, it suggests that there might be a problem with collinearity among the variables (Hair et al., 2017, 2019). Table 5 indicates that the VIF of all the factors falls within the range of 1.684–2.641. The VIF results were precisely under the prescribed threshold. Thus, the collinearity issue does not exist.

Table 5. VIF Scores (Multicollinearity Tests).

Source: Authors’ calculation.

Notes: VIF = variance inflation factor.

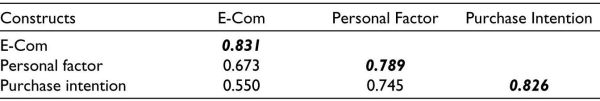

Measurement Model Evaluation

We analyzed the reliability and validity of the survey tools through a measurement model. When assessing validity, researchers consider both convergent and discriminant validity. Convergent validity denotes the degree of correlation observed among measures that purport to determine a shared construct. The AVE and outer loading values assess convergence. Fornell and Larcker (1981) suggest AVE values for each dimension above 0.50 to evaluate convergent validity. Hair et al. (2019) recommend that the construct’s item outer loadings exceed 0.70. Table 6 shows AVE values ranged between 0.622 and 0.690; the outer loading values ranged from 0.749 to 0.861. Thus, the convergent validity of the model was established. Cronbach’s alpha and composite reliability (CR) are two statistical measures that assess items’ reliability within a context. Values above 0.60 are considered satisfactory reliability (Razi-ur-Rahim & Uddin, 2021). We also checked discriminant validity using the criteria proposed by Fornell and Larcker, as well as the heterotrait–monotrait method (Henseler et al., 2015). The results of both tests are reported in Table 7 and Table 8. All the values met this criterion. An item’s ability to distinguish between variables is measured regarding discriminant validity. When the square root of AVE exceeds the correlation of the latent variables, discriminant validity is established (Fornell & Larcker, 1981; Hair et al., 2017). Table 7 shows that the square root of AVE values of all the constructs was more significant than the inter-construct correlations; also, the latent variable correlation value should not be greater than 0.9 (Lee et al., 2015). The results uncover that the highest inter-item correlation value is 0.745 (i.e., between PI and PF). Thus, the discriminant validity of the measurement model is established.

Table 6. Measurement Model Analysis.

Source: Authors’ calculation.

Note: p < .001, CR = composite reliability; AVE = average value extracted.

Table 7. Discriminant Validity Estimations (Fornell–Larcker Criterion).

Source: Authors’ calculation.

Notes: The square roots of the AVEs are the bold italic elements.

Table 8. Discriminant Validity Estimations—Heterotrait–Monotrait Ratio (HTMT): Matrix.

Source: Authors’ calculation.

Structural Model Evaluation

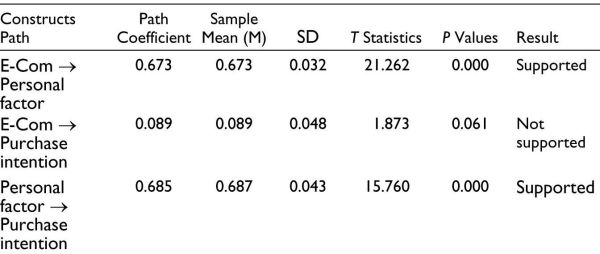

Table 9 provides the outcomes of the structural model testing, showcasing the hypothesized relationships between the constructs: e-commerce (E-Com), personal factor, and online purchase intention. We evaluated the adequacy of the hypothesized model by assessing the value of R2. The table includes path coefficients, sample means, standard deviations, T statistics, P values, and the result of hypothesis testing for each relationship. Figure 2 shows the result of the partial least squares analysis.

Table 9. The Results of the Structural Model Testing.

Figure 2. Path Coefficient and P-value and Outer Weights/Loadings and T-value.

The path coefficient (β = 0.673) indicates a strong positive relationship between e-commerce and personal factor. The t-statistic (t = 21.262) is significantly high, and the P-value (p = .000) is well below the .05 threshold. Therefore, the hypothesis that e-commerce positively influences personal factor is strongly supported. Additionally, the results of the hypothesis testing showed that the path coefficient (β = 0.089) suggests a weak positive relationship between e-commerce and purchase intention. The t-statistic of (t = 1.873) is below the typical threshold for significance, and the P-value (p = .061) is above the .05 cutoff. Hence, the hypothesis that e-commerce directly influences purchase intention is not supported. The path coefficient (β = 0.685) indicates a strong positive relationship between personal factor and purchase intention. The t-statistic (t = 15.760) is significantly high, and the P-value (p = .000) indicates strong statistical significance. Therefore, the hypothesis that personal factors positively influence purchase intention is well supported. These findings suggest that the influence of e-commerce on purchase intention is mediated through personal factors. Therefore, personal factors play a crucial role in translating the influence of e-commerce into purchase intention.

Mediation Analysis

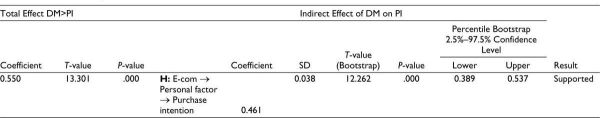

Table 10 illustrates the total effects and indirect effects of e-commerce on purchase intention. The mediation effects of personal factors are also examined.

Table 10. Mediation Analysis with Total Effect.

Mediation analysis assessed the mediating role of PF on the linkage between E-com and PI. The results (Table 10) revealed that the total effect of e-commerce on purchase intention was significant (H: β = 0.550, t = 13.301, p = .000) with the inclusion of the mediating variable PF. The indirect effect of E-com on PI through PF was found to be significant (E-com>PF>PI: β = 0.461, t = 12.262, p = .000). This confirms our hypothesis. It indicates that personal factors play a key role in mediating the relationship between e-commerce and purchase intentions.

Discussion and Implication

The findings of this study reveal significant insights into the impact of digital marketing on online purchase intentions among banking professionals, mediated by personal factors. The discussion section delves into the interpretations of these results, connecting them with existing literature and emphasizing their implications for practitioners and policymakers. The study confirmed that e-commerce significantly influences personal factors such as personal values, occupation, lifestyle, income, societal trends, cultural influences, and social recommendations. These findings align with previous studies by Hernández et al. (2010) and Wagner Mainardes et al. (2019), highlighting the role of e-commerce in shaping consumer behavior through convenience and variety. Personal factors were found to have a substantial impact on online purchase intentions. This supports the work of Das and Mishra (2022) and Forghani et al. (2022), who noted that personal values and lifestyle significantly dictate online shopping behavior. The influence of occupation and income on purchase intentions underscores the nuanced preferences of banking professionals as they balance professional responsibilities with personal shopping needs. This study shows that e-commerce platforms do not have a direct positive impact on online purchase intentions, which confirms the hypotheses developed based on prior literature. Personal factors mediated the relationship between e-commerce and online purchase intentions. This mediation effect suggests that digital marketing strategies must consider these factors to target and influence consumer behavior effectively. The study’s findings resonate with the theoretical framework proposed by Chen and Yang (2021) and Dabholkar and Sheng (2012), who emphasized the importance of personal factors in the digital marketing context.

Implications

E-commerce platforms need to tailor their marketing strategies to address the personal values, occupational needs, and lifestyle preferences of banking professionals. Understanding these factors can help design personalized marketing campaigns that resonate more effectively with this demographic. Enhancing the convenience and variety of products and offering exclusive deals can further boost purchase intentions among banking professionals. Platforms should leverage data analytics to gain insights into consumer preferences and optimize their offerings accordingly. Digital marketers should focus on creating personalized and targeted marketing content that aligns with the personal factors influencing purchase intentions. This includes leveraging social media influencers and e-WOM to enhance credibility and trust among consumers. The role of social recommendations and cultural influences should be emphasized in marketing strategies. Marketers can harness these elements to create a sense of community and belonging, thereby driving impulsive purchases and strengthening customer loyalty. Policymakers should consider the implications of digital marketing and e-commerce on consumer behavior, particularly regarding consumer protection and data privacy. Ensuring that consumers’ personal information is safeguarded while providing personalized shopping experiences is crucial. Regulations that promote fair and ethical digital marketing practices can help maintain a balance between consumer interests and business growth. This includes guidelines on transparent advertising, data usage, and influencer marketing.

Conclusion

The study provides a comprehensive analysis of the impact of digital marketing on online purchase intentions among banking professionals, highlighting the mediating role of personal factors. The findings underscore the importance of e-commerce platforms and digital marketers in understanding and addressing the unique preferences and needs of this demographic. Businesses can enhance their engagement with banking professionals by tailoring marketing strategies to personal values, occupational needs, and lifestyle preferences, ultimately driving higher online purchase intentions. The implications for policymakers emphasize the need for balanced regulations that protect consumer interests while fostering a thriving digital marketplace. This research contributes to the academic discourse on digital consumer behavior and offers valuable insights for future studies. The focus on banking professionals provides a nuanced understanding of how digital marketing influences purchase intentions in a specific professional context, paving the way for further exploration of other demographic segments.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship, or publication of this article.

Funding

The authors received no funding for authorship and/or publication of this article.

Data Availability

Data may be made available on request.

ORCID iD

Shams Mukhtar  https://orcid.org/0000-0003-3015-7984

https://orcid.org/0000-0003-3015-7984

Babi.png) Rosario, A., de Valck, K., & Sotgiu, F. (2020). Conceptualizing the electronic word-of-mouth process: What we know and need to know about eWOM creation, exposure, and evaluation. Journal of the Academy of Marketing Science, 48(3), 422–448. https://doi.org/10.1007/s11747-019-00706-1

Rosario, A., de Valck, K., & Sotgiu, F. (2020). Conceptualizing the electronic word-of-mouth process: What we know and need to know about eWOM creation, exposure, and evaluation. Journal of the Academy of Marketing Science, 48(3), 422–448. https://doi.org/10.1007/s11747-019-00706-1

Ben Belgacem, S., Khatoon, G., Bala, H., & Alzuman, A. (2024). The role of financial technology on the nexus between demographic, socio-economic, and psychological factors, and the financial literacy gap. Sage Open, 14(2), 21582440241255678. https://doi.org/10.1177/21582440241255678

Carrington, M. J., Neville, B. A., & Whitwell, G. J. (2014). Lost in translation: Exploring the ethical consumer intention–behavior gap. Journal of Business Research, 67(1), 2759–2767. https://doi.org/10.1016/j.jbusres.2012.09.022

Chen, N., & Yang, Y. (2021). The impact of customer experience on consumer purchase intention in cross-border E-commerce: Taking network structural embeddedness as mediator variable. Journal of Retailing and Consumer Services, 59, 102344. https://doi.org/10.1016/j.jretconser.2020.102344

Chin, W. W. (1995). The holistic approach to construct validation in IS research: Examples of the interplay between theory and measurement. 16, 34–43. Administrative Sciences Association of Canada.

Dabholkar, P. A., & Sheng, X. (2012). Consumer participation in using online recom-mendation agents: Effects on satisfaction, trust, and purchase intentions. The Service Industries Journal, 32(9), 1433–1449. https://doi.org/10.1080/02642069.2011.624596

Dang, A., & Raska, D. (2022). National cultures and their impact on electronic word of mouth: A systematic review. International Marketing Review, 39(5), 1182–1225. https://doi.org/10.1108/IMR-12-2020-0316

Das, S., & Mishra, M. (2022). The role of digital citizenship behavior on digital marketing and consumer buying behavior. In Rajagopal & R. Behl (Eds.), Managing disruptions in business: causes, conflicts, and control (pp. 207–221). Springer International Publishing. https://doi.org/10.1007/978-3-030-79709-6_11

Dash, G., & Paul, J. (2021). CB-SEM vs PLS-SEM methods for research in social sciences and technology forecasting. Technological Forecasting and Social Change, 173, 121092. https://doi.org/10.1016/j.techfore.2021.121092

Dwivedi, Y. K., Ismagilova, E., Hughes, D. L., Carlson, J., Filieri, R., Jacobson, J., Jain, V., Karjaluoto, H., Kefi, H., Krishen, A. S., Kumar, V., Rahman, M. M., Raman, R., Rauschnabel, P. A., Rowley, J., Salo, J., Tran, G. A., & Wang, Y. (2021). Setting the future of digital and social media marketing research: Perspectives and research propositions. International Journal of Information Management, 59, 102168. https://doi.org/10.1016/j.ijinfomgt.2020.102168

Forghani, E., Sheikh, R., Hosseini, S. M. H., & Sana, S. S. (2022). The impact of digital marketing strategies on customer’s buying behavior in online shopping using the rough set theory. International Journal of System Assurance Engineering and Management, 13(2), 625–640. https://doi.org/10.1007/s13198-021-01315-4

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. https://doi.org/10.1177/002224378101800104

González, A. M., & Bello, L. (2002). The construct “lifestyle” in market segmentation: The behaviour of tourist consumers. European Journal of Marketing, 36(1/2), 51–85. https://doi.org/10.1108/03090560210412700

Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. https://doi.org/10.1108/EBR-11-2018-0203

Hair, J., Hult, G. T. M., Ringle, C., & Sarstedt, M. (2017). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM).

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. https://doi.org/10.1007/s11747-014-0403-8

Hernández, B., Jiménez, J., & José Martín, M. (2011). Age, gender and income: Do they really moderate online shopping behaviour? Online Information Review, 35(1), 113–133. https://doi.org/10.1108/14684521111113614

Hernández, B., Jiménez, J., & Martín, M. J. (2010). Customer behavior in electronic commerce: The moderating effect of e-purchasing experience. Journal of Business Research, 63(9), 964–971. https://doi.org/10.1016/j.jbusres.2009.01.019

Hu, X., Chen, X., & Davison, R. M. (2019). Social support, source credibility, social influence, and impulsive purchase behavior in social commerce. International Journal of Electronic Commerce, 23(3), 297–327. https://doi.org/10.1080/10864415.2019.1619905

Hughes, C., Swaminathan, V., & Brooks, G. (2019). Driving brand engagement through online social influencers: An empirical investigation of sponsored blogging campaigns. Journal of Marketing, 83(5), 78–96. https://doi.org/10.1177/0022242919854374

Kwahk, K.-Y., & Kim, B. (2017). Effects of social media on consumers’ purchase decisions: Evidence from Taobao. Service Business, 11(4), 803–829. https://doi.org/10.1007/s11628-016-0331-4

Lee, V.-H., Ooi, K.-B., Chong, A. Y.-L., & Lin, B. (2015). A structural analysis of greening the supplier, environmental performance and competitive advantage. Production Planning & Control, 26(2), 116–130. https://doi.org/10.1080/09537287.2013.859324

Lichtenstein, S., Lichtenstein, G., & Higgs, M. (2017). Personal values at work: A mixed-methods study of executives’ strategic decision-making. Journal of General Management, 43(1), 15–23. https://doi.org/10.1177/0306307017719702

Mukhtar, S., Mohan, A. C., & Chandra, D. (2023). Exploring the influence of digital marketing on consumer behavior and loyalty. International Journal of Research-Granthaalayah, 11(9), 1–18.

Pappas, I. O., G. Pateli, A., N. Giannakos, M., & Chrissikopoulos, V. (2014). Moderating effects of online shopping experience on customer satisfaction and repurchase intentions. International Journal of Retail & Distribution Management, 42(3), 187–204. https://doi.org/10.1108/IJRDM-03-2012-0034

Razi-ur-Rahim, M., & Uddin, F. (2021). Assessing the impact of factors affecting the adoption of online banking services among university students. Abhigyan, 38(4), 44–51. https://doi.org/10.56401/Abhigyan_38.4.2021.44-51

Rosenbloom, R. S. (2000). Leadership, capabilities, and technological change: The transformation of NCR in the electronic era. Strategic Management Journal, 21 (10–11), 1083–1103. https://doi.org/10.1002/1097-0266(200010/11)21:10/11<1083:: AID-SMJ127>3.0.CO;2-4

Servon, L. J., & Kaestner, R. (2008). Consumer financial literacy and the impact of online banking on the financial behavior of lower-income bank customers. Journal of Consumer Affairs, 42(2), 271–305. https://doi.org/10.1111/j.1745-6606.2008.00108.x

Setyani, V., Zhu, Y.-Q., Hidayanto, A. N., Sandhyaduhita, P. I., & Hsiao, B. (2019). Exploring the psychological mechanisms from personalized advertisements to urge to buy impulsively on social media. International Journal of Information Management, 48, 96–107. https://doi.org/10.1016/j.ijinfomgt.2019.01.007

Shergill, G. S., & Chen, Z. (2004). Shopping on the internet–online purchase behavior of New Zealand consumers. Journal of Internet Commerce, 3(4), 61–77. https://doi.org/10.1300/J179v03n04_04

Sweeney, J. C., & Soutar, G. N. (2001). Consumer perceived value: The development of a multiple item scale. Journal of Retailing, 77(2), 203–220. https://doi.org/10.1016/S0022-4359(01)00041-0

Swinyard, W. R., & Smith, S. M. (2003). Why people (don’t) shop online: A lifestyle study of the internet consumer. Psychology & Marketing, 20(7), 567–597. https://doi.org/10.1002/mar.10087

van der Heijden, H., Verhagen, T., & Creemers, M. (2003). Understanding online purchase intentions: Contributions from technology and trust perspectives. European Journal of Information Systems, 12(1), 41–48. https://doi.org/10.1057/palgrave.ejis.3000445

Vinson, D. E., Scott, J. E., & Lamont, L. M. (1977). The role of personal values in marketing and consumer behavior. Journal of Marketing, 41(2), 44–50. https://doi.org/10.1177/002224297704100215

Wagner Mainardes, E., de Almeida, C. M., & de-Oliveira, M. (2019). e-Commerce: An analysis of the factors that antecede purchase intentions in an emerging market. Journal of International Consumer Marketing, 31(5), 447–468. https://doi.org/10.1080/08961530.2019.1605643

Yan, Q., Wu, S., Zhou, Y., & Zhang, L. (2018). How differences in eWOM platforms impact consumers’ perceptions and decision-making. Journal of Organizational Computing and Electronic Commerce, 28(4), 315–333. https://doi.org/10.1080/10919392.2018. 1517479